When you decide to invest, it seems simple: you are ready to invest and some want to raise funds. Both sides know what they want. However, there are many specific services used as testing grounds for the meeting of these stakeholders.

Investor portals are online services where anyone can choose an interesting project and invest money in it to get a certain income. The principle of operation can be compared to marketplaces. It is not the seller and the buyer who find each other on the portals, but the investor and the borrower. Borrowers attract investments for the development of their business, and investors get profit in a relatively short time.

How Investor Portals Work

An investor portal is a system in the information and telecommunication network, Internet, used to conclude investment agreements using information technologies and technical means of this system, access to which is provided by the operator of the investment platform.

Investment platforms can be designed to serve various types of investors, support different investment options (e.g. micro-investing, long-term investing), asset classes ( cash equivalents, stocks, bonds,commodities, cryptocurrencies, etc.), regions, etc.

Project key stages typically include:

- Business, market and end-user analysis

- Investment platform design (concept to a clear solution design)

- Tech stack selection

- Project planning

- Investment platform development

- Integration

- Platform deployment and release

After-launch support and evolution

5 Benefits of an Investor Portal

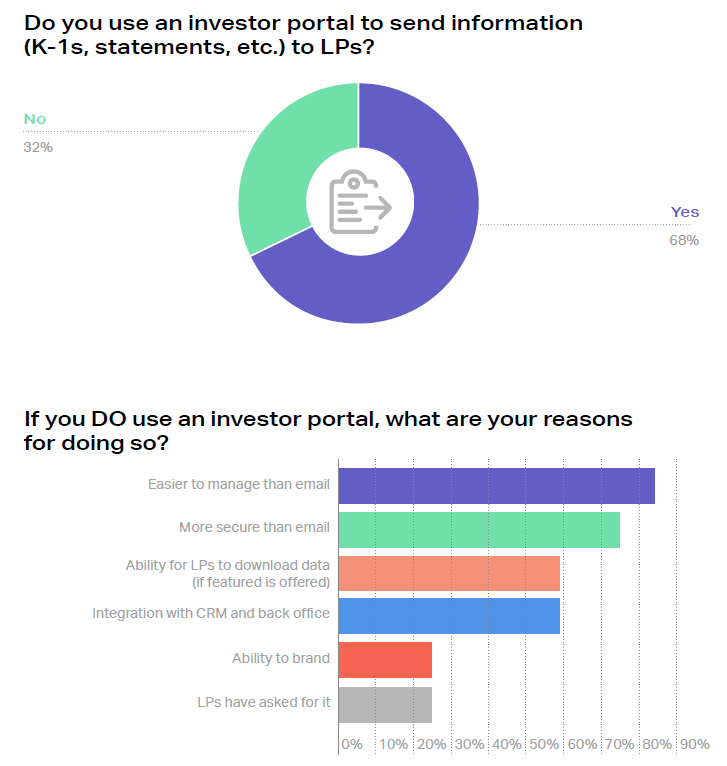

Source: https://www.allvuesystems.com/resources/investor-portal-technology-creates-a-win-win-environment-for-lp-communications/

- Reducing Transactions Time

For any commercial real estate transaction, time is critical. Having all complex, financial, and other relevant property information in a cloud-based repository helps provide immediate access and eliminate issues that can cause disagreements between parties to a transaction and their representatives.

By centralizing and organizing all relevant documents in one place, manual email, and messaging are greatly reduced, allowing you to act much faster. - Simplification of Workflows

Investors can easily and quickly search, analyze, and invest in projects through the online platform, without the need for complex and time-consuming procedures.

It can not only reduce the time it takes to disseminate information to your investors and their representatives but also simplify and automate the process of approving a non-disclosure agreement or confidentiality agreement. - Increased Safety and Security

Investor portals provide a high level of security and privacy to attract both investors and entrepreneurs, allowing investment sales brokers to securely exchange sensitive and important information with clients and their representatives, such as legal counsel.

It is fully encrypted, so login is required and provides different levels of privacy settings and controls to limit the level of access for different clients - User Experience Optimization

The investor portal is a cloud-based resource center that can be accessed from anywhere using a desktop, tablet, or mobile device via the internet or a data connection. Mobility 'on the go' helps meet the needs of busy clients by allowing them to easily and conveniently communicate and share documents with brokers and other transaction participants from anywhere in the world, 24 hours a day, 7 days a week.

It also improves interaction and communication with clients and investors by providing all parties with a convenient way to communicate without a flood of emails. - Expert Analysis of Investment Projects

A cloud-based document processing solution also allows trading brokers to collect important information throughout the transaction process, including who is accessing documents and how often.

Tracking user portal activity levels can provide key insights into investor concerns and your efficiency, as it provides a comprehensive view of actions and interactions throughout the transaction process. The analytics data collected can also be valuable in helping you improve tactical selling and follow-up strategies.

How to Determine Whether an Investor Portal Is Reliable

Here are the main criteria by which you can distinguish a reliable portal:

- The portal is included in the register of investment platform operators on the Central Bank's website.

- Investors and borrowers have permanent free access to a personal account via the website or app.

- The portal publishes annual reports indicating the amount of capital raised, projects financed, and the number of investors.

- Information about borrowers is as detailed as possible: company names, legal addresses, TINs, website addresses, and other data that can be checked independently if desired.

- The portal does not guarantee 100% profit and does not offer to invest at very high interest rates. No one can guarantee success in business, and unfulfilled promises are usually made by fraudsters who hope to attract inexperienced investors.

Conclusion

Investor portals are an innovative approach to investing and fundraising for entrepreneurs. They provide a convenient platform where investors and entrepreneurs can meet and realize their investment goals and business projects. The micro-investing platform market currently represents about 20.9% of the total online investment market sales. With the growing popularity and development of new technologies, investment portals are becoming increasingly important in the world of investment and may become a key tool for investors and entrepreneurs in the future.